As we venture into 2024, savvy investors are targeting opportunities to nurture long-term wealth. Exchange-Traded Funds (ETFs) have emerged as a powerful tool for attaining these goals, offering spread and access to a range of sectors. Pinpointing the right ETFs can significantly impact your portfolio's performance over the long run.

- Consider ETFs that specialize on sustainable investments, as growing public demand for environmentally conscious solutions is expected to fuel significant expansion in this sector.

- Embrace ETFs that align with emerging innovations, such as artificial intelligence, which have the potential to disrupt various industries.

- Harness ETFs that provide exposure to international markets, as allocation across geographic regions can reduce risk and boost portfolio returns.

Bear in mind that previous performance is not a guarantee of future results. It's vital to conduct thorough research and engage a qualified financial advisor before making any investment choices.

Unlock the Market with QQQ: A Comprehensive Guide

Investing in the stock market can seem daunting, but with the right knowledge and tools, it can be a rewarding journey. One popular avenue for investors is through Exchange Traded Funds (ETFs), and among them, the Invesco QQQ Trust (QQQ) stands out as a prominent choice. This ETF tracks the performance of the Nasdaq-100 Index, which comprises 100 of the largest non-financial companies listed on the Nasdaq Stock Market.

This comprehensive guide delves into the intricacies of QQQ, providing you with insights to navigate this dynamic market segment effectively. We'll explore the historical performance, underlying holdings, trading strategies, and potential risks involved. By understanding these key aspects, you can make informed decisions and potentially optimize your investment returns.

- Uncover the composition of the Nasdaq-100 Index

- Analyze QQQ's past performance and trends

- Develop a sound trading strategy tailored to your risk tolerance

- Reduce potential risks associated with QQQ investments

Whether you're a seasoned investor or just initiating your journey, this guide offers valuable knowledge to help you prosper in the market with QQQ.

Access Broad Market Exposure With SPY Investing

Investing in the Standard & Poor's 500 (S&P 500) Index Tracking Fund is a popular and effective way to participate in the overall performance of the U.S. stock market. This investment vehicle tracks the actions of the S&P 500, which comprises leading companies across various sectors. By investing in SPY, you gain participation to a wide range of blue-chip stocks, allowing you to mitigate risk and potentially boost your portfolio's growth.

- Features of Investing in SPY:

- Portfolio Allocation: SPY spreads your investments across five hundred of companies, reducing the impact of any isolated stock's performance.

- Accessibility: As an ETF, SPY is highly liquid, meaning you can sell shares easily on major stock exchanges.

- Transparency: SPY's holdings are publicly disclosed, allowing investors to understand the composition of their investment.

Delving into the Dow Jones ETF

Unlocking the potential the Dow Jones ETF necessitates in-depth analysis. This ever-changing market financial tool offers access to some of the mostrecognized companies in the United States. Investors aiming for a strategic approach can benefit from this ETF to enhance their portfolio allocation.

- Before diving in, it's crucial to the risks and rewards associated with ETFs.

- Conduct thorough research on the ETF's holdings and its historical performance.

- Determine your desired risk tolerance before making any decisions.

Building a Winning ETF Portfolio with QQQ, SPY & DIA

A well-diversified portfolio remains essential for achieving long-term investment goals. When constructing an ETF portfolio, combining prominent ETFs like QQQ, SPY, and DIA can provide a robust structure.

QQQ tracks the NASDAQ-100 index, offering exposure to leading technology companies. SPY mirrors the S&P 500, encompassing a broad range of large-cap U.S. equities. DIA represents the Dow Jones Industrial Average, focusing on blue-chip companies. By integrating these ETFs, investors can tap into different sectors and market capitalizations, mitigating risk and possibly enhancing returns.

- Evaluate your individual investment aims and risk tolerance when determining the appropriate allocation for each ETF.

- Periodically review and rebalance your portfolio to ensure it aligns with your evolving needs and market conditions.

- Seek professional financial advice if you require assistance in constructing a tailored ETF portfolio.

Building a Robust Long-Term Portfolio: The Power of QQQ, SPY & DIA impact

A well-diversified portfolio is the cornerstone of long-term investing success. Examine incorporating key ETFs like QQQ, SPY, and DIA to build a robust foundation for your financial future. QQQ tracks the Nasdaq 100, providing exposure to prominent technology companies. SPY, the S&P 500 ETF, more info represents the performance of the broad U.S. stock market. DIA, the Dow Jones Industrial Average ETF, offers focused exposure to 30 blue-chip companies.

Employing these ETFs can help you spread risk and capitalize on market expansion.

- Keep in mind that investing involves risk, and past performance is not indicative of future results.

- Perform thorough research and consult with a qualified financial advisor before making any investment decisions.

Jake Lloyd Then & Now!

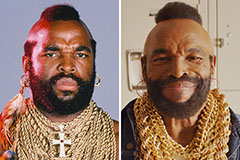

Jake Lloyd Then & Now! Mr. T Then & Now!

Mr. T Then & Now! Brandy Then & Now!

Brandy Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!